Turning 65 Soon?

There are plenty of advisors who teach tell people how to make money but very few who teach people how to keep what they have toiled to earn. It seems everyone out there wants to get their hands on our money. It seems the insurance companies love to collect premiums but hate to pay out benefits. When it comes to government it seems one party wants to take all our money and give it to everyone that is poorer than us. The other party wants to take all our money and give it to everyone who is richer than us. Wall Street just wants to take all our money period, they do throw us a bone every now and then to keep us in the game. They teach us to “buy and hold” but if that’s such good advice why do they not follow it themselves? The legal profession knows it is in their best interest to keep the crooks on the street because that’s provides them with a never-ending source of income. Of course at the top of the list is all those true scam artists and their annoying ”robo” calls.

The only chance we have of keeping our money in our pockets is to educate ourselves so that we recognize the pitfalls and take the appropriate steps to avoid them. I have over 30 years experience in the tax and financial consulting business. Every financial decision we make has both strong and weak points. There is no such thing as a perfect product or service that is totally perfect. I have always strived to make sure that my clients get to make wise, informed decisions by making sure they always understand both the strengths and the weaknesses of all their choices.

-Ron

Books by Ron Vejrostek

Ron isn’t just a wonderful guy and a razor sharp bookkeeper, he’s also a celebrated author. Take a look at some of these books and see for yourself how his common sense approach to challenging subjects like Medicare, Annuities, taxes, small business and more are a breath of fresh air! If you’d like to purchase one of the books, click the image and you’ll be taken to Ron’s Amazon store.

"I am tired of seeing all the bad information and trickery that firms use to depart good hard working people from their hard earned monies and so I strive everyday to help inform people of both the strengths and weaknesses of every product that they might be considering."

-Ron Vejrostek Share to Twitter

Financially Intact

Using personal stories and detailed statistics to show the many different ways people lose their capital, this book addresses legal issues, identity theft, scams, taxes, insurance, and the myriad con artists of Wall Street who try to line their pockets with your hard-earned fortune. For fans of Flash Boys, by Michael Lewis; Everyone’s Money Book, by Jordan Goodman; and Financial Guidebook, by Suze Orman

Turning 65? 2024 and Beyond

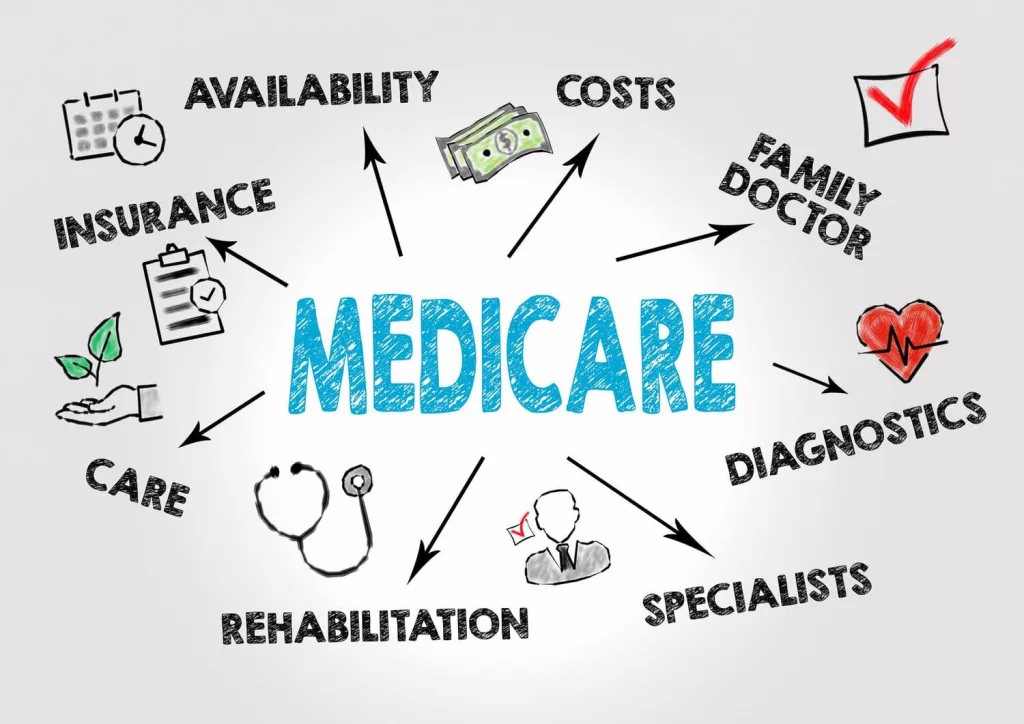

Many financial changes occur right around a person's attaining the age of 65. The most obvious one being that a person becomes eligible for Medicare. This has proven to be a much more confusing decision than one would think. Much of the information that people get is usually one sided and biased between supplemental plans and Advantage plans. This book brings to you an unbiased look at all of one's choices.

Income and Expense Tracker

If you don't want Uncle Sam to become a silent, profit-sharing partner then this book is for you. Columnar pads are nice, but they don't teach you anything or tell you what to label those columns. This income and expense tracker has pre'labeled the columns with the most used expenses. The book, not just a ledger, goes on to explain and define many of the most used categories such as income and the difference between office expenses and supplies and all the other most common expenses.

Small Business Bookkeeping Ledger

This workbook will help those who have, or are starting, a new small business to keep track of their income and expenses by using this small business bookkeeping ledger. This works the same way as a spreadsheet except for the main categories have already been entered for you by someone who has been doing small business accounting and tax preparation for over 40 years.